The commercial casualty market has shown strong premium growth and rate firming, and the volatility of the market cycles over the last two years appears to have largely subsided. Some specific product lines and industry sectors remain as notable exceptions. These casualty lines remain, in our view, impacted by steadily rising claim severity, nuclear verdicts, social inflation, and uncertainty around rising inflation. The continued rise in labor cost and medical services has likely further driven the steady increase in premium growth. The recent results of the January 2022 treaty renewals reflect a considerably more cautious approach with capacity deployment and more meaningful pricing level increases, dependent upon the loss experience and performance of the carrier portfolio. All combined, we expect that the overall casualty market to continue with low to moderate price increases as we move further into 2022.

Following a favorable performance in 2021 by many markets, we have noticed that many insurers have started to shift towards more of a growth strategy, and recent improvements in insurer profitability have increased casualty insurers’ appetite. There is more focus towards achieving higher account retention and new business goals, while still looking to improve loss ratios for profitable growth. Previously declined risks are being reconsidered and renewals are being offered with more favorable terms in order to retain the business. There remains a conservative approach to the long tail lines, and there is still an overall environment of selectivity. We have further observed that, dependent upon the quality of risk and with the exception of certain challenging industry sectors such as transportation, construction, and habitational, capacity levels are generally viewed as adequate, but full capital deployment remains limited to best in class.

Umbrella and excess liability lines continue to receive, on average, the higher percentage increases, although they have recently showed moderation in conjunction with the other casualty lines. These casualty lines of the larger account segment were more negatively impacted on pricing and capacity in comparison to more muted increases and adjustments with the smaller commercial market during the recent market cycle.

Over the last two years, we’ve seen a steady stream of new entrants and capacity entering the market, and we believe this new competition is another contributing factor that is keeping price increases in moderation and stabilizing volatility. We expect that the new capital will continue to be supported from both domestic and global sources with European, London and Bermuda markets.

MARKET DRIVERS

In recent casualty market cycles, we have witnessed that carriers were reducing their limit offerings and raising retention levels to address the higher loss frequency and severity of their portfolios. Starting in 2021 and continuing into 2022, we are seeing casualty line capacity become more available. Most renewals are maintaining limits at expiring levels. Carriers are still holding back on offering their maximum limits. As a result, in our view, there is still a need in many instances to place added layers and quota share structures on the larger risk.

As reported previously, we have seen that limits on primary general liability lines are being stretched to reach higher umbrella attachment points. In many cases, traditional carriers which only offered umbrella and excess casualty are now more often leveraging their positions to obtain the primary casualty lines. As a result, there are more of these supported placements developing on the larger casualty renewals. We have witnessed that deductible levels have stabilized overall, and carriers are still looking to raise retentions where underwriting performance remains strained.

In our view, underwriting terms have now steadied across most casualty lines and have shown some signs of moderating. Plus, there is less emphasis towards stricter terms and exclusionary policy language. While COVID-19 exclusions remain, emphasis is being shifted towards more challenging sectors and specific exposures that include chemical compounds, pharmaceuticals, sexual abuse, habitational, and residential construction, along with wildfire-exposed risks. It also appears that insurers are becoming more focused on environmental, social, and governance (ESG) policies.

The frequency and severity of cyber liability loss events continues to challenge insurers. In our view, market conditions in this sector are creating very challenging renewals, with rigorous underwriting and a push for significant rate and deductible increases, coverage restrictions, and capacity limitations on ransomware.

We have seen that excess workers’ compensation and employers’ liability continues as a more profitable line of business, and placements are remaining flat or reducing at a few percentage points on renewals. The reduced claim activity and improved loss results through the pandemic has been a major driver.

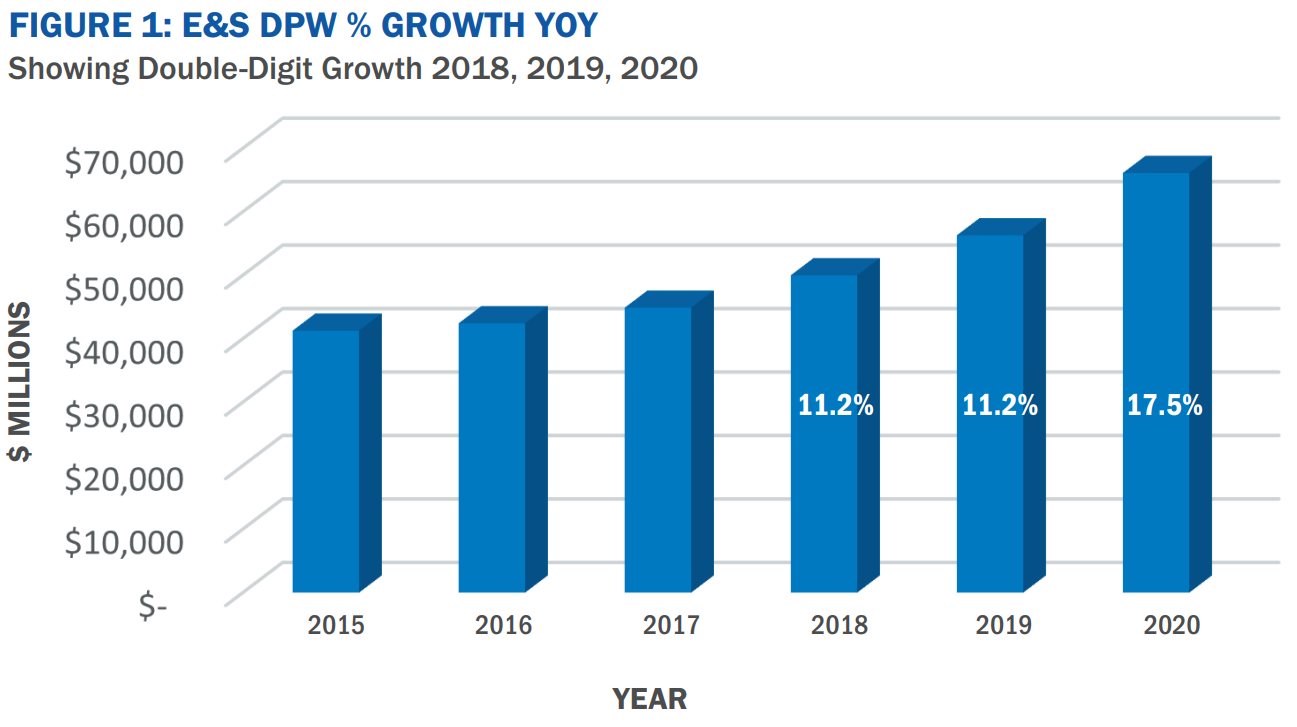

The excess & surplus lines segment has continued to grow and expand, in our view, experiencing a surge in premium growth, representing year-over-year double-digit increases in 2018, 2019 and 2020 according to AM Best’s September 16, 2021 Market Segment Report. (See Figure 1) In addition, the latest figures available from the WSIA 2021 Surplus Lines Annual Report noted surplus lines premium volume again increased 21.9% through Q2 of 2021.

INDUSTRY SPOTLIGHTS

TRANSPORTATION

Transportation accounts remain a significant underwriting concern, particularly those heavily weighted with fleet exposures and where loss severity is driven by the high proportion of litigated claims and “nuclear” verdicts. We have noticed that there is an emphasis on telematics and other innovations that are increasingly necessary to detail and highlight on underwriting submissions. In addition, in our view, with the easing of the pandemic conditions and more drivers on the road, it is expected that there will be an increase in the loss frequency of the primary auto insurers and umbrella / excess markets.

As reported in the Woodruff Sawyer newsletter, P&C Looking Ahead 2022, “the frequency of severe ($15 million or greater) liability losses is expected to continue to grow as a result of social inflation, which is experiencing the phenomenon of increasing claims costs due to changing societal factors, such as legal, advertising, financing, appeal of class action lawsuits, and growing public distrust of corporations.” The newsletter continues to explain the impact of social inflation on large auto liability claims by reviewing the data in four-year windows in order to eliminate the impact of inconsistencies from year to year. Woodruff Sawyer learned the number of auto claims with settlement and judgment value of $15 million or greater increased 168%, from 35 cases in 2008-2011 to 94 in years 2016-2019.

CONSTRUCTION

The Infrastructure Investment and Jobs Act passed in late 2021, we believe, will have a large impact on all aspects of the American construction sector. Much needed improvements of roads, bridges, travel hubs and power infrastructure are on expected to break ground in the near future. However, construction and renovation-related activities have been seriously impacted by the variant viral surges, labor shortages and global supply chain interruptions. The placement of excess liability capacity remains challenging, especially for residential / multi-family. As we move into 2022, new markets are entering this segment and offering additional capacity to fill in for the previous voids. The Florida high-rise residential construction market remains an exception, with carriers’ offerings at lower capacities, in addition to underwriting restrictions being imposed.

REAL ESTATE

It appears that the real estate sector remains challenged with rising frequency of losses and larger claim settlements year-over-year. We have seen that umbrella and excess liability capacity remain strained for certain classes. This limited capacity is contributing to higher pricing and the need to accept more restrictive terms for portions of their location schedules. Portfolios that include multi-family are most impacted, in comparison to commercial and retail. Key drivers include the rising liability risk of crime-related claims in specific geographies. This can result in carriers requiring stricter policy language, such as issuing exclusions for assault & battery (A&B) or only offering small sub-limits as a coverage option. It seems that real estate owners and property managers need to differentiate their risk and highlight strong risk management protocols, operational controls, and claims management policies.

REINSURANCE

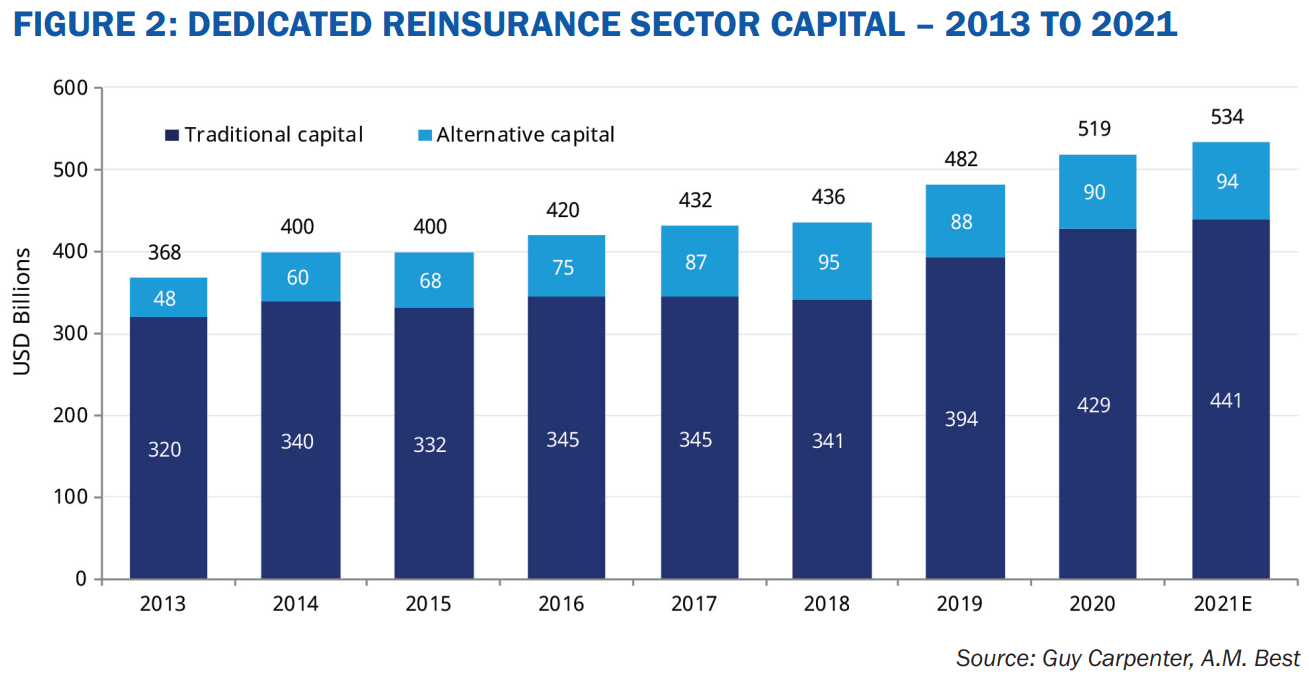

As illustrated in the Guy Carpenter graph (See Figure 2), building on increases over the last 18 months, reinsurance pricing for the January 1, 2022 renewals resulted in more meaningful levels compared to the very moderate increases that were delivered over years 2019, 2020 and 2021. Guy Carpenter reported casualty renewals were generally orderly, and capacity was ample across most lines. Pressure was seen in certain pockets, including cyber aggregate, clash cover, and loss-impacted excess of loss programs. Recognition was given to limits management and tighter underlying policy terms and conditions of their cedent insurers. As further shared by Guy Carpenter, “Conditions were bifurcated between non-loss-impacted and loss-impacted programs.” Therefore, programs impacted by loss or presenting a greater risk experienced more challenging renewals. Strong capitalization continues to support the reinsurance market. Guy Carpenter estimates that the total dedicated reinsurance capital continues to grow across the reinsurance market, meeting industry needs despite significant losses in some sectors.

SUMMARY

The casualty insurance market has moderated and the volatility of the past market cycles over the last two years has largely stabilized. Pricing in most casualty lines remains firm, with capacity offerings selectively deployed. There continues to be a steady stream of new entrants and expanded capacity entering the market, in combination with strong reinsurance support.

The RT Casualty team has been built with the necessary knowledge and teamwork to fully assist its retail brokers in the preparation for renewals and new business negotiations. We understand each account is unique and has different risk characteristics. RT Casualty recommends establishing the renewal strategy and targets early to allow sufficient time to explore alternatives and properly structure the program design to ensure access to favorable outcomes.

This advanced planning allows us adequate time to properly differentiate the insured’s risk profile for presentation to the casualty markets. This results in offering access to a competitive buying strategy with a high-quality market submission, which enables the insured to receive and evaluate all viable renewal options. Throughout the process, RT Casualty maintains close coordination with our retail brokers to maximize direct communication with their insureds and markets.